8.5 Multistage Finance Problems

Which equation to use?

When presented with a finance problem (on an exam or in real life), you’re usually not told what type of problem it is or which equation to use or, if you are using Excel, which command to use. The calculator TVM Solver is nice because it is in one location, but it can be difficult to determine what is positive and what is negative. Here are some hints on deciding which equation, command or sign to use based on the wording of the problem.

The easiest types of problem to identify are loans. Loan problems almost always include words like: “loan”, “amortize” (the fancy word for loans), “finance (a car)”, or “mortgage” (a home loan). Look for these words. If they’re there, you’re probably looking at a loan problem. To make sure, see if you’re given what your monthly (or annual) payment is, or if you’re trying to find a monthly payment. Using technology, loans usually have a future value, or FV of 0, PV or the principal of the loan is positive because you are getting the money in your pocket to buy something. The payment is negative because it is money leaving your pocket to the account or loan.

If the problem is not a loan, the next question you want to ask is: “Am I putting money in an account and letting it sit, or am I making regular (monthly/annually/quarterly) payments or withdrawals?” If you’re letting the money sit in the account with nothing but interest changing the balance, then you’re looking at a compound interest problem. The exception would be bonds and other investments where the interest is not reinvested; in those cases you’re looking at simple interest. In compound interest, your present value or PV is negative because you are putting it away from you in the bank. Payment is 0 and FV is positive because you can get that money back to buy something or re-invest it.

If you’re making regular payments or withdrawals, the next questions is: “Am I putting money into the account, or am I pulling money out?” If you’re putting money into the account on a regular basis (monthly/annually/quarterly) then you’re looking at a basic Annuity problem. Basic annuities are when you are saving money. Usually in an annuity problem, your account starts empty, and has money in the future. This means your PV is 0, Payment is negative because you are putting it in and FV is positive.

If you’re pulling money out of the account on a regular basis, then you’re looking at a Payout Annuity problem. Payout annuities are used for things like retirement income, where you start with money in your account, pull money out on a regular basis, and your account ends up empty in the future. In this case, PV is negative, Payments are positive and FV is usually 0, although, you can put a future value in if you would like to end up with a certain amount of money.

Remember, the most important part of answering any kind of question, money or otherwise, is first to correctly identify what the question is really asking, and to determine what approach will best allow you to solve the problem.

Try it Now

For each of the following scenarios, determine if it is a compound interest problem, a savings annuity problem, a payout annuity problem, or a loans problem. Then solve each problem.

- Marcy received an inheritance of $20,000, and invested it at 6% interest. She is going to use it for college, withdrawing money for tuition and expenses each quarter. How much can she take out each quarter if she has 3 years of school left?

- Paul wants to buy a new car. Rather than take out a loan, he decides to save $200 a month in an account earning 3% interest compounded monthly. How much will he have saved up after 3 years?

- Keisha is managing investments for a non-profit company. They want to invest some money in an account earning 5% interest compounded annually with the goal to have $30,000 in the account in 6 years. How much should Keisha deposit into the account?

- Miao is going to finance new office equipment at a 2% rate over a 4 year term. If she can afford monthly payments of $100, how much new equipment can she buy?

- How much would you need to save every month in an account earning 4% interest to have $5,000 saved up in two years?

Multistage Problems

Many finance problems in real life can’t be solved using a single application of any of the finance formulas we have learned in the prior sections. Instead, we have to combine multiple calculations. The calculations can continue to be done using formulas, but often times people will use calculators with specialty functions for doing the calculations. In this section we determine the values needed to use the formulas, but not show the details of the solving; you could instead solve each portion using a specialty calculator if you have access to one.

Example of Several Stage Compound Interest

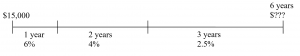

Suppose you deposited $15,000 into a bank account offering a special 6% APR. After one year, they lower the promotional APR to 4%, then two years after that lower it again to 2.5%. If the account compounds monthly, what will your account balance be 6 years after the initial deposit?

We can imagine this situation as three distinct time phases, each with a different interest rate.

To handle the change of interest rates, it is easiest to imagine that each time the interest rate changes we withdraw all our money then redeposit it into a new account at a different rate.

For the first year:

![]()

Using the compound interest equation, we find the balance after 1 year would be:

A = $15,925.17

We can then use this as the principal for the next two years at a different rate, as if we had withdrawn that money and reinvested it at 4%:

![]()

Using the compound interest equation, we find the balance after these next 2 years would be:

![]()

Using that as the principal for the last three years:

![]()

Using the compound interest equation, we find the balance at the end would be:

![]()

After the 6 years, the final balance would be $18,591.23

Example Saving for Retirement

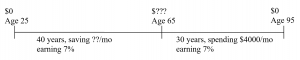

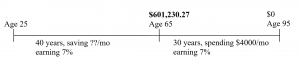

Jenny plans to retire at age 65, and estimates she will need $48,000 a year in retirement for 30 years. To save for retirement, she plans to put money every month into her 401k plan at work. If Jenny is currently 25, how much will she need to save each month to meet her retirement goal, assuming her retirement accounts earn an average of 7% per year.

We can think about this as two separate phases: the accumulation phase and the spending phase. We assume Jenny starts with no money and the beginning, and will completely spend down her account by the time she’s 95.

To decide which phase to start with, we look to see which we have the most information for. In the first phase, we don’t know how much she will save each month, and we don’t know the ending balance of the account. For the second phase, we know everything except the starting balance of the account, so we will start the problem in the second phase. Basically, we are going to work the problem backwards, using her spending requirement to determine how much she needs at retirement, then use that value to determine how much she needs to save each month.

The second phase is a payout annuity problem, where:

![]()

Using the payout annuity formula to find the principal gives:

![]()

This is how much Jenny will need at retirement to meet her spending needs, and fills in a part of our timeline:

Now we can work on the first phase, which is a savings annuity problem where the desired end balance is the $601,230.27 we just found.

![]()

Using the savings annuity formula to solve for the deposit amount gives:

![]()

Jenny will need to save $229.06 per month to meet her retirement goals.

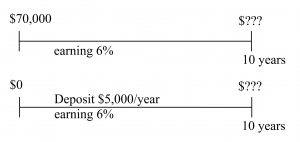

Example Rolling a 401k to an IRA

Ula just got a new job. She had $70,000 in a 401k at her old job that she rolled over into an IRA. She plans to continue contributing $5,000 a year into her IRA. If her account earns 6% compounded annually, how much will she have in her IRA in 10 years?

The challenge with this problem is that our savings annuity formula assumed that our account balance started at zero. While we could try to build a new formula to handle this situation, we can more easily envision it as two different money streams, as if the original $70,000 is invested in a different account than future contributions.

In the first stream of money, we have $70,000 earning 6% interest for 10 years, which is a basic compound interest problem:

![]()

Using the compound interest formula to solve for the ending balance:

![]()

In the second stream of money, we are depositing $5,000 a year, a savings annuity problem:

![]()

Using the savings annuity formula to find the ending balance:

![]()

Now that we know the ending balance of each stream of money, we can add those together to find the total balance of the account at the end of the ten years:

$125,359.34 + $65,903.97 = $191,263.31

Example of Refinancing a Mortgage

Five years ago a couple purchased a home for $260,000, making a 20% down payment and financing the rest with a 30-year adjustable rate mortgage fixed at 3% for the first 5 years. Now that the fixed rate period is up, the couple is facing a higher adjustable rate. They now plan to refinance into a fixed rate 30-year mortgage at 4%. What will their new monthly payments be? Assume there are no costs associated with the refinance.

To determine the monthly payments for the refinance, we first need to know how much the refinanced loan amount will be. The amount refinanced will be the same as the remaining loan balance on the original loan after 5 years. We will start by finding the details of the original loan.

The 20% down payment will be $260,000(0.20) = $52,000, leaving $208,000 to be financed.

We start by finding the payments on the original loan:

![]()

Using the loan formula to solve for the payment,

![]()

Now we can find the remaining balance on the original loan after 5 years. As discussed in the last section, we can find this by determining the amount of loan that can be paid off with payments of $876.94 in the remaining 25 years:

![]()

Using the loan formula to solve for the remaining balance,

P = $184,926.00

So after 5 years, the remaining balance on the loan is $184,926.00, and that is the amount we will refinance in a new 30 year mortgage at the fixed 4% rate:

![]()

Solving for the new payment amount:

PMT = $882.87

Because of the higher interest rate the monthly payment increased, even though the loan amount was less at refinance. Most likely this increase is much smaller than the one the couple would have faced from the original loan’s rate adjusting.

Notice also that because of the refinance, the couple will end up making payments for a total of 35 years on the house.

In those first 5 years, the couple paid a total of $876.94(12)(5) = $52,616.40, and reduced the loan balance by ($208,000 – $184,926) = $23,074, meaning they paid $29,542.40 in interest during the first 5 years.

In the remaining 30 years, the couple will pay $882.87(12)(30) = $317,833.20, and reduce the loan balance by $184,926, meaning they will pay $132,907.20 in interest during these 30 years.

In total, the couple will pay $132,907.20 + $29,542.40 = $162,449.60 in interest over the 35 years.

Try it Now Answer

- This is a payout annuity problem. She can pull out $1833.60

- This is a savings annuity problem. He will have saved up $7,524.11

- This is compound interest problem. She would need to deposit $22,386.46

- This is a loans problem. She can buy $4,609.33 of new equipment.

- This is a savings annuity problem. You would need to save $200.46 each month

Media Attributions

- 85example1

- 85example2

- 85example3

- 85example4